Want more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter.

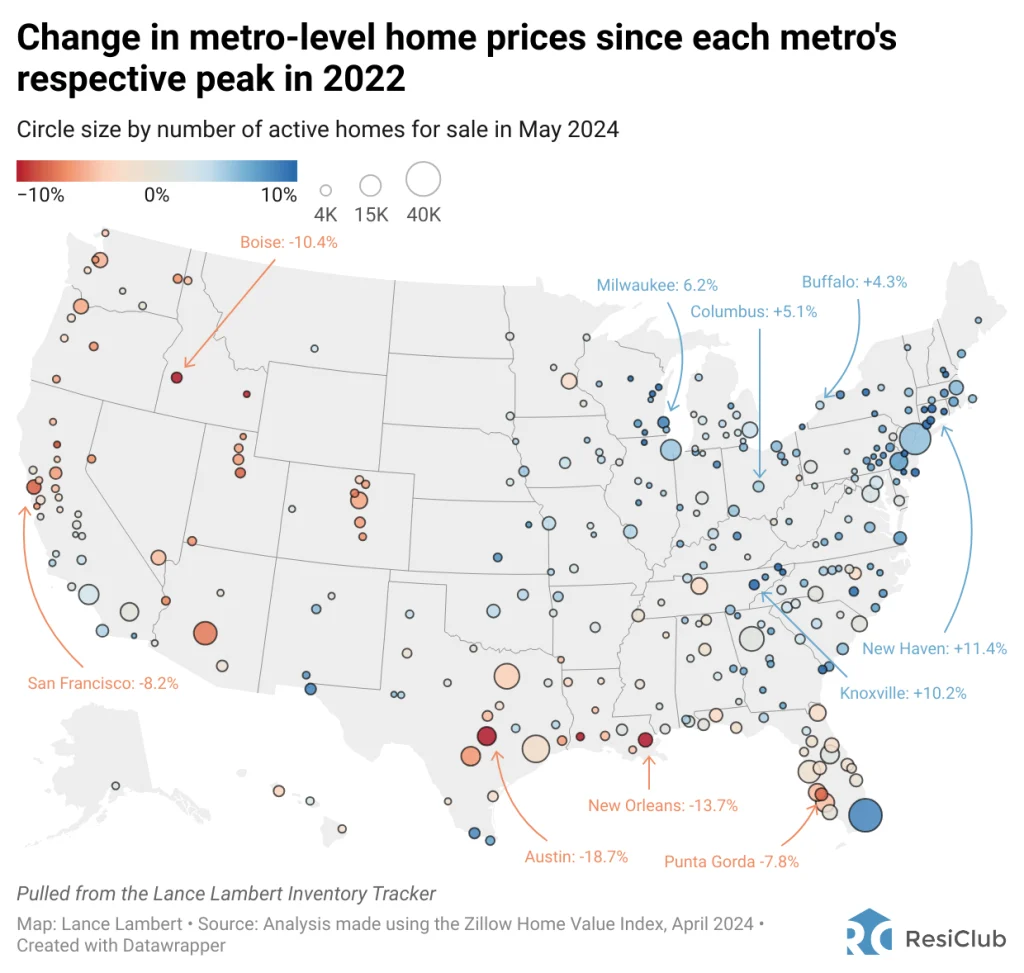

To better understand how home prices have shifted since the mortgage rate shock, ResiClub‘s Lance Lambert House Price Tracker has begun keeping tabs on “shift since 2022 peak.” It reveals the extent of local home price changes since their peak in 2022, coinciding with the height of the pandemic housing boom in most markets.

Among the 300 largest housing markets, home prices in these 10 metros have increased the most since their 2022 peaks:

- Trenton, New Jersey: 13.3%

- Hartford, Connecticut: 12.9%

- Atlantic City, New Jersey: 12.8%

- Rockford, Illinois: 11.8%

- Savannah, Georgia: 11.6%

- New Haven, Connecticut: 11.4%

- Syracuse, New York: 11.4%

- Vineland, New Jersey: 10.9%

- Norwich, Connecticut: 10.9%

- Torrington, Connecticut: 10.7%

Among the 300 largest housing markets, home prices in these 10 metros have fallen the most since their peaks in 2022:

- Austin, Texas: -18.7%

- New Orleans: -13.7%

- Lake Charles, Louisiana: -11.7%

- Boise, Idaho: -10.4%

- Idaho Falls, Idaho: -9.7%

- Chico, California: -8.8%

- San Francisco: -8.2%

- Provo, Utah: -8.0%

- Punta Gorda, Florida: -7.8%

- Phoenix: -7.3%

Click here to view an interactive version of the map below.

Clik here to view.

National home prices, as measured by the Zillow Home Value Index, are up 1.3% above the 2022 peak as of April 2024. However, as the map shows above, there’s a great deal of variation in housing markets across the county.

In Austin’s market, demand has dropped harder than most housing markets, leading to a price correction. This bigger than average demand decline is due to pandemic-related migration inflating Austin home prices excessively. Once rates spiked, and pandemic migration slowed, those frothy prices simply put affordability too far beyond local Austin incomes. Moreover, Austin had a lot of new construction supply coming online over the past two years, which made up for the pullback in new resale listings caused by the lock-in effect.

Meanwhile, for Northeast markets like New Haven, where fundamentals are less distorted and there’s less supply coming available, the pullback in supply has outpaced the reduction in demand. This delicate equilibrium between supply and demand dynamics keeps housing prices, for now, on an upward trajectory in New Haven, allowing sellers to maintain the upper hand in negotiations.

Big picture: U.S. home prices have been in a period of sideways movement following the 2022 mortgage rate shock. However, under the surface, some housing markets have seen home price corrections, while others have climbed higher.