Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

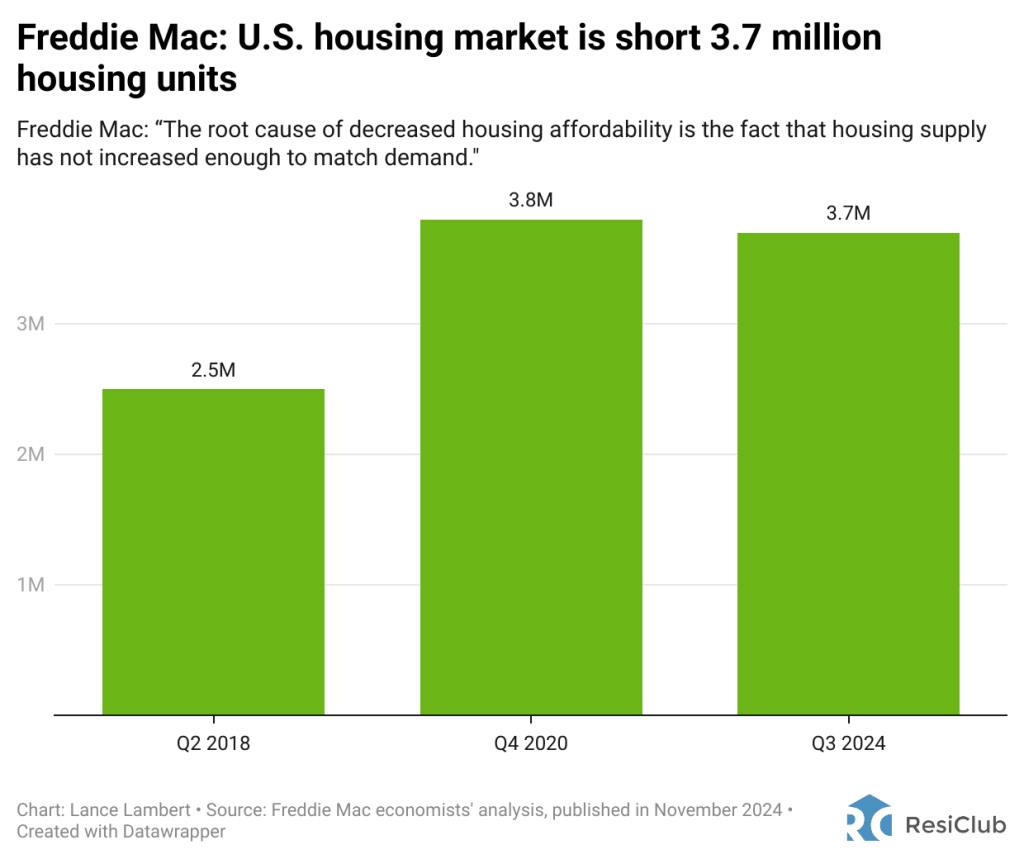

According to a new report published by Freddie Mac economists, the U.S. housing stock—currently at 147 million units—is 3.7 million units below the 150.7 million housing units that the government-sponsored enterprise estimates are currently needed in the U.S. housing market.

While the current 3.7 million housing shortage is smaller than the 3.8 million unit shortfall estimated by Freddie Mac in Q4 2020, it remains significantly higher than their Q2 2018 estimate, which indicated a 2.5 million unit shortage.

“The root cause of decreased housing affordability is the fact that housing supply has not increased enough to match demand. Inadequate housing supply leads homeowners and renters to bid up the sale price and rent of available housing, which puts a squeeze on affordability,” wrote Freddie Mac economists in their report.

How did Freddie Mac conduct its analysis? First, economists at Freddie Mac calculated how much demand for housing should exist based on the underlying population and age demographics, as well as the number of households that would form if high housing costs weren’t preventing people from moving out of their parents’ homes. Freddie Mac estimates that 1 million U.S. households haven’t been formed because a lack of housing supply has strained affordability.

Second, economists at Freddie Mac examined vacancy rates to determine how many vacant homes the housing market needs to function efficiently. Freddie Mac concluded that the market requires an additional 2.7 million vacant housing units to be considered balanced.

Using these two components, Freddie Mac concluded that the national housing market is short 3.7 million housing units. (Note: They didn’t publish a regional analysis.)

“While there is reason to be optimistic about the housing market given the demographic tailwind and the cohort of millennials and young adults entering the housing market, high mortgage rates have put a damper on affordability. Rising home prices have also had an effect and are directly related to the supply shortage,” wrote Freddie Mac economists.

How can the housing shortage be resolved?

“Building more houses is essential, but builders are also contending with high interest rates,” wrote Freddie Mac economists. “There is no silver bullet to alleviating this ongoing shortage. That said, there are viable options being considered and acted upon including accessory dwelling units (ADUs), Community Land Trusts, condominium conversions, [and] manufactured homes, to name a few. We will continue to study this topic and work with the industry to uncover potential solutions.”