Want more housing stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the daily free ResiClub newsletter.

Active housing inventory for sale across much of the country is rising year-over-year as strained housing affordability softens demand and extends the time homes spend on the market.

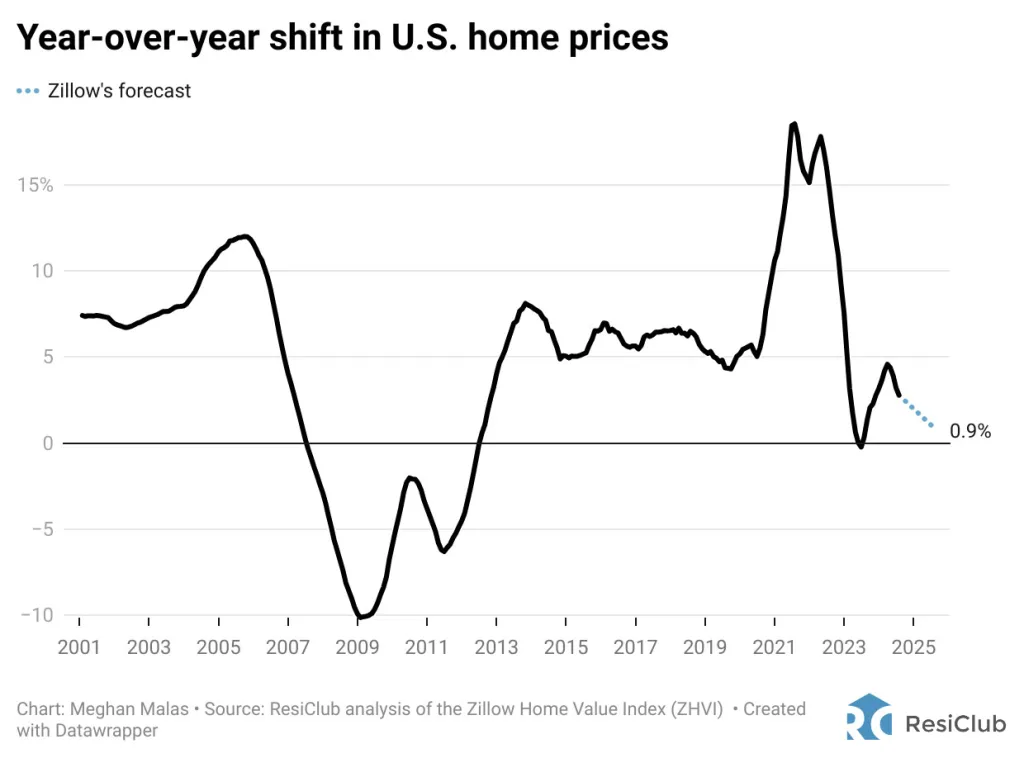

That’s starting to translate into decelerated national home price growth—something economists at Zillow expect to continue over the next year.

U.S. home prices, as measured by the Zillow Home Value Index, increased by +2.8% from July 2023 to July 2024.

Zillow’s latest revised forecast expects U.S. home prices to rise just +0.9% over the next 12 months, from July 2024 to July 2025.

“Competition for homes and price appreciation tapered off faster than normal in July as high housing costs continued to stymie shoppers. . . . More options for buyers means less intense competition for each home. That’s evident in the growing share of home sellers cutting their prices. More than 26% of homes on Zillow received a price cut in July, the highest share for any July since at least 2018, when the dataset began,” wrote Zillow economists last week.

Zillow economists added that: “Looking beyond 2024, easing inflation and more accommodating mortgage rates should improve affordability slightly. This would help stimulate housing activity, with both new listings and sales rising over the longer term.”

Keep in mind, if Zillow is right, and national home prices rise just +0.9% over the next 12 months, it’ll mean that some housing markets see outright home price declines.